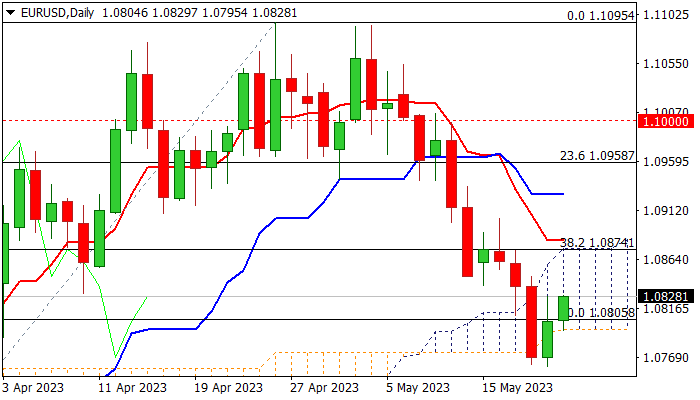

Thickening daily cloud likely to limit recovery

The Euro extends bounce from temporary base at 1.0760 into second straight day, after failing to register a clear break below daily cloud (spanned between 1.0796 and 1.0875).

Fresh strength was sparked by weaker dollar and oversold conditions on daily chart, which prompted a partial profit-taking.

Recovery is likely to be limited while holding below 1.0870/80 zone (converged 10/55DMA’s / daily cloud top / broken Fibo 38.2% of 1.0516/1.1095, reverted to resistance) as overall structure on daily chart is bearish (rising negative momentum / daily Tenkan/Kijun-sen in bearish configuration).

Last week’s bearish close marked the second consecutive week in red and weighs on near-term action, supporting scenario of limited correction before bears regain control.

Caution on sustained break above daily cloud top and daily Tenkan-sen (1.0875/83) which would generate initial signal of reversal and shift near-term focus to the upside, with lift above daily Kijun-sen (1.0927) needed to confirm.

Res: 1.0848; 1.0875; 1.0883; 1.0927

Sup: 1.0805; 1.0760; 1.0737; 1.0700