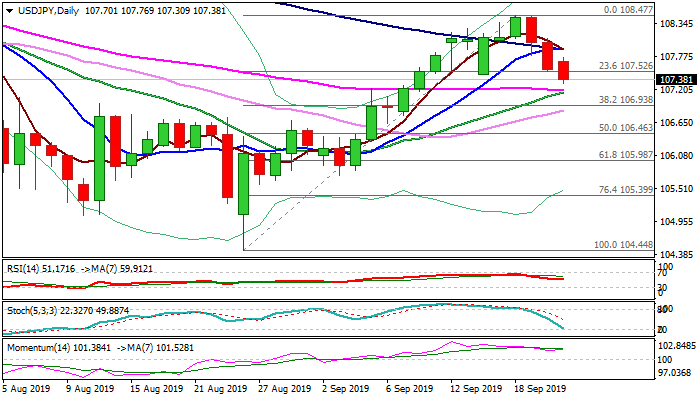

Extension of pullback pressures strong support at 107.30

The pair holds in red for the third straight day and extends weakness to two-week low at 107.30 in European trading on Monday.

Safe-haven yen continues to benefit from persisting uncertainty over US/China trade conflict as the latest talks, despite being described as constructive by both sides, did not result in breakthrough.

Daily chart shows larger uptrend from 104.44 (26 Aug low) still intact, as fresh bearish extension on Monday approaches strong supports at 107.18 zone (daily cloud top / converged 10/20DMA’s) which are expected to contain pullback and keep bulls intact.

Rising bullish momentum and daily stochastic approaching oversold territory, support the notion, however, near-term risk will remain shifted lower while the price stays below converged 10/100DMA’s (107.91).

Stronger bearish signal can be expected on violation of 107.18 support and extension below next pivot at 106.93 (Fibo 38.2% 104.44/108.47) that would open way for deeper correction.

Res: 107.52; 107.76; 107.90; 108.08

Sup: 107.30; 107.18; 106.93; 106.60