Fading risk sentiment and economic worries warn of dollar’s recovery stall

The dollar weakens further vs yen in early Friday’s trading as risk sentiment, sparked by vaccine news fades and exploding new coronavirus cases prompt authorities to impose further restrictions.

Fears of further economic slowdown on fresh lockdowns, sours the sentiment, prompting traders into safer assets.

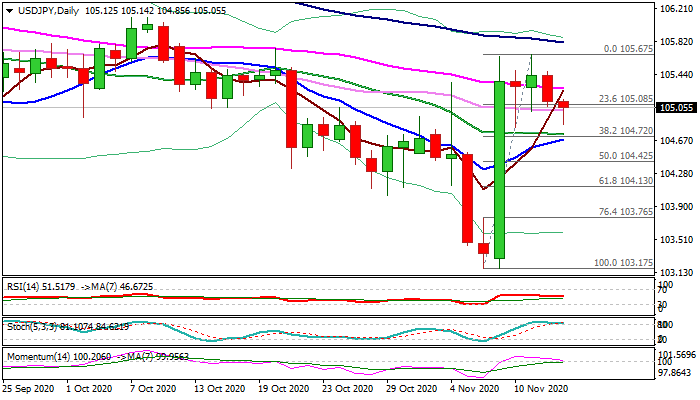

Fresh weakness after multiple failure to clearly break through thin daily cloud, signals that dollar recovery attempts run out of steam and developing initial reversal signals on daily chart.

Fading bullish momentum and stochastic about to reverse from overbought zone point to rising downside risk.

Key support at 104.70 zone (Fibo 38.2% of 103.17/105.67, reinforced by converging 10/20DMA’s) comes in focus, with clear break here to generate stronger reversal signal.

Otherwise, bulls are expected to remain in play while 104.70 pivots hold, with extended consolidation to precede fresh attempts higher, as Monday’s massive bullish candle of continues to underpin the action.

Res: 105.14; 105.28; 105.47; 105.67

Sup: 104.85; 104.70; 104.42; 104.13