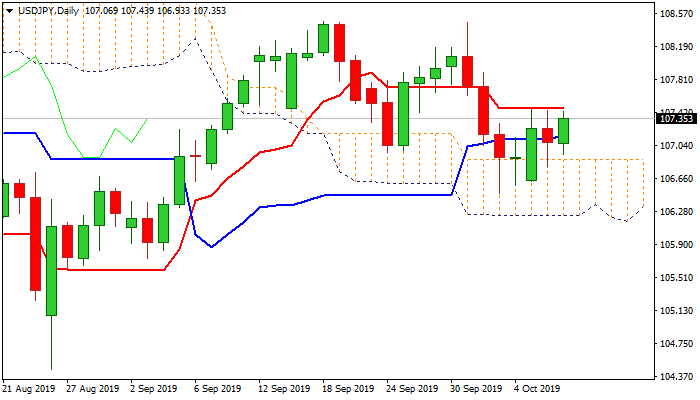

Fresh advance attempts again towards pivotal Tenkan-sen barrier

The pair was up around 50-pips in Asia / Europe on Wednesday, to pressure again key barrier at 107.47 (daily Tenkan-sen / Fibo 50% of 108.46/106.48 downleg), where the action in past two days was repeatedly capped.

The downside remains protected by daily cloud top (106.88) which contained dips on Tuesday / today.

North-heading daily stochastic and momentum (though momentum is still in the negative territory) support the action, as fading hopes for US/China trade deal underpin the dollar.

Break and close above Tenkan-sen line is needed to generate bullish signal for extension of recovery leg from 106.48 (3 Oct low) towards next pivotal barriers at 107.60/64 (converged falling 100/20DMA’s); 107.71 (Fibo 61.8% of 108.46/106.48) and psychological 108 barrier (also Fibo 76.4%).

Broken Fibo 38.2% barrier (107.24) and broken daily Kijun-sen (107.15) mark initial supports and guard more significant daily cloud top, close below which would generate negative signal.

The minutes of latest FOMC meeting are due later today and may provide fresh signals, as markets turn focus towards key events on Thursday, US CPI data and beginning of high-level US/China trade talks.

Res: 107.47; 107.64; 107.71; 108.00

Sup: 107.15; 106.94; 106.88; 106.63