Fresh risk mode elevates dollar for eventual attack at psychological 110 barrier

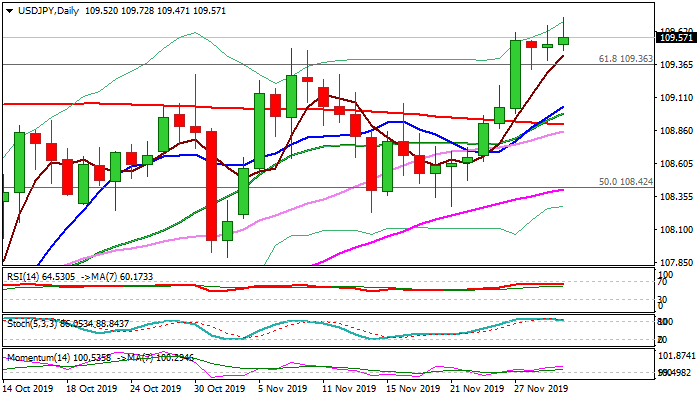

The pair ticked higher on Monday and hit new high at 109.72 (the highest since 30 May), ignoring negative signals that developed on daily chart (last Thursday’s hanging man candle and Friday’s Doji with long upper shadow.

Stronger than expected China’s Manufacturing PMI boosted risk appetite and inflated dollar on Monday, signaling an end of two-day congestion after last week’s strong rally, which generated bullish signal on break and close above key barriers at 109.36/48 (Fibo 61.8% of 112.40/104.44 / 7 Nov former high).

Larger uptrend remains intact, with double golden-cross (10/200 and 20/200DMA’s) and rising daily bullish momentum underpinning the action for final push towards psychological 110.00 barrier.

Caution on possible bulls’ fatigue on approach to 110 pivot as daily stochastic is overbought, with extended consolidation likely to precede probes through obstacles at 109.81 (200WMA) and 110.00 (psychological).

Broken Fibo 61.8% barrier, reinforced by broken 55WMA (109.36/33) should ideally keep the downside protected and keep bulls intact, but deeper dips towards 109.00 zone (diverging 10/20/200DMA’s) cannot be ruled out.

Res: 109.72; 110.00; 110.52; 110.67

Sup: 109.47; 109.36; 109.04; 108.90