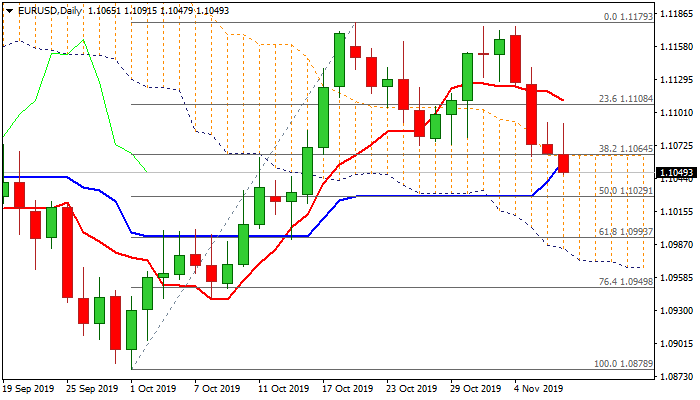

Fresh weakness is on track for close below pivotal daily cloud top support

The Euro returned below cracked 1.1064 pivot (daily cloud top / Fibo 38.2% of 1.0878/1.1179 rally), coming under renewed pressure after short-lived rally on optimistic trade news was capped by the base of thick hourly cloud (1.1091).

Subsequent weakness accelerated and is on track for close below daily cloud top / rising daily Kijun-sen (1.1064/60) which would generate negative signal and open way towards 1.1029 (50% retracement) initially, with risk of extension towards next key levels at 1.1000/1.0993 (psychological / Fibo 61.8%).

Prevailing negative tone from European Commission’s quarterly economic forecast, in light of global slowdown on trade conflict and Brexit, contributed to Euro’s fresh weakness.

Daily studies continue to gain negative momentum and also support bears, after failing to benefit from Wednesday’s inverted hammer.

Broken cloud top now reverted to initial resistance, followed by spike highs of Wednesday / today (1.1092/91).

Res: 1.1064; 1.1092; 1.1101; 1.1111

Sup: 1.1043; 1.1029; 1.1000; 1.0993