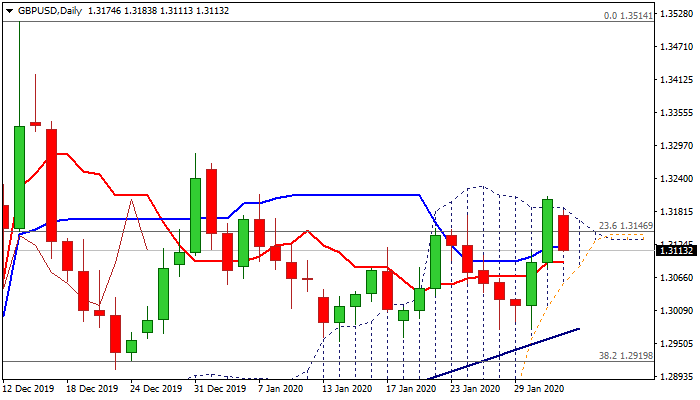

Fresh weakness signals false break above daily cloud

Cable opened with gap-lower and extended pullback on Monday, signaling that Friday’s probe above daily cloud top after impressive rally (0.83%), was a false break.

Initial optimism after the Britain officially exited the EU, started to fade and drained demand.

The price action of past two weeks remains within daily cloud and lacking direction after cloud boundaries repeatedly contained attack, however, the cloud is narrowing and will twist on Wednesday, losing its significance.

Daily studies remain mixed (MA’s in positive setup and stochastic heading north are conflicted by fading bullish momentum and falling RSI) and lack clearer direction signal.

On the other side, negative signal is developing on monthly chart after the action in Dec was strongly rejected at the base of thick monthly Ichimoku cloud and January’s trading ended in Hanging man candle, adding to reversal signals after strong four-month uptrend showed signs of stall, weighed by massive monthly cloud.

Fresh weakness today probes below daily Kijun-sen (1.3119) and eyes pivotal supports at 1.3092/85 (daily Tenkan-sen / cloud base) with close below here expected to generate fresh negative signal and risk further easing towards psychological 1.30 support and a higher base at 1.2975 zone (30/20 Jan lows).

Only firm break above 1.3200 zone would bring bulls in play and shift near-term focus higher.

Res: 1.3138; 1.3166; 1.3183; 1.3209

Sup: 1.3092; 1.3085; 1.3066; 1.3032