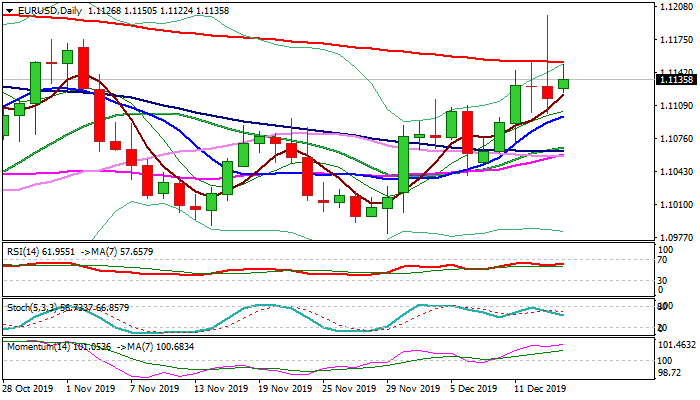

Friday’s strong upside rejection adds to warning of reversal

Early Monday’s action remains capped by 200DMA (1.1152) with Friday’s bearish daily candle with very long upper shadow warning of upside rejection.

Friday’s spike to 1.1199 (just ticks ahead of pivotal Fibo barrier at 1.1208 (61.8% of 1.1412/1.0878 descend) was short-lived, with additional negative signal generated by return and close below 200SMA.

PMI data released from Germany and EU in early European trading on Monday showed values below expectations that would further hurt bulls.

Neutral momentum and RSI and south heading stochastic on daily chart also warn, with initial negative signal expected on clear break of cracked support at 1.1115 (Fibo 38.2% of 1.0981/1.1199).

Key supports lay at 1.1074/64 (daily cloud top / converged daily MA’s (20/30/55/100) which reinforce Fibo 61.8% level), with break here to confirm reversal.

On the other side, lift and close above 200DMA would sideline downside risk, but only sustained break above 1.1200/08 pivots would neutralize and bring bulls back fully in play.

Res: 1.1150; 1.1179; 1.1200; 1.1208

Sup: 1.1115; 1.1101; 1.1090; 1.1064