Geopolitical tensions continue to underpin oil prices

WTI oil remains in green for the fifth straight day and extends recovery to three-week high on Monday.

Rising tensions between the US and Iran and new sanctions Tehran that Washington is about to announce, keep oil prices supported.

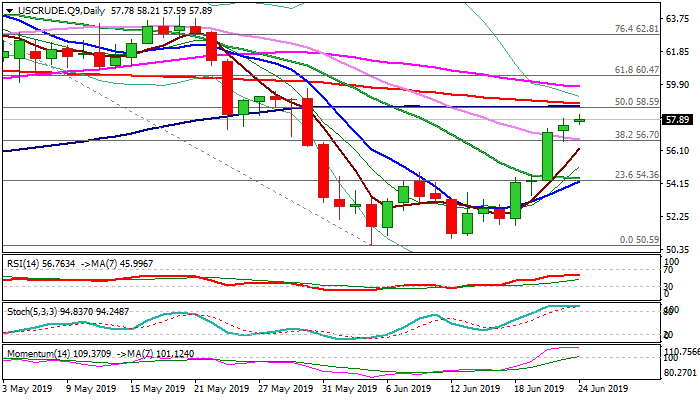

Bulls are approaching strong barriers at $58.59/80 zone (50% of $66.58/$50.59 / converged 100/200SMA’s) violation of which would generate fresh bullish signal for extension of recovery from $50.59 (5 June low).

Strong bullish momentum underpins the action, however, overbought daily stochastic and flat RSI warn that bulls may run out of steam.

Overall picture is positive as global supply remains tight as OPEC+ group is likely to extent its production cut deal of 1-2 July meeting in Vienna.

Positioning before final push through 100/200SMA’s can be anticipated, with dips expected to hold above broken Fibo 38.2% barrier at $56.70 (reinforced by 30SMA) to keep bulls in play.

Res: 58.21; 58.59; 58.80; 59.79

Sup: 57.59; 56.70; 56.23; 54.44