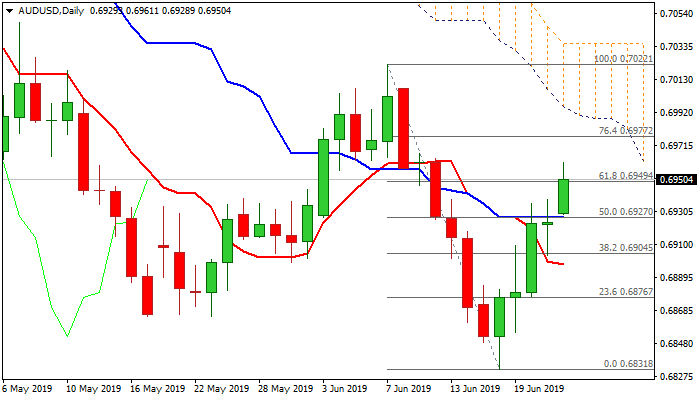

Extended bulls struggle at key Fibo barrier

The Australian dollar extends advance on Monday after Friday’s long-legged Doji and cracked pivotal Fibo barrier at 0.6949 (61.8% of 0.7022/0.6831).

Fresh bullish extension hit two-week high at 0.6961, boosted by dovish tone from Fed, which could result in 0.5% rate cut in July.

Extended short squeeze may show signs of stall as bulls lack momentum, daily stochastic is overbought and falling an thickening daily cloud weighs (cloud base lays at 0.6990).

Failure to clearly break 0.6949 Fibo barrier would generate initial negative signal, however, bulls are expected to remain in play while the price holds above broken 20SMA (0.6931).

Adding to negative signals are expectations of RBA rate cut by 0.25% on the policy meeting next week.

Res: 0.6961; 0.6977; 0.6990; 0.7000

Sup: 0.6931; 0.6922; 0.6910; 0.6897