Gold rises above $1800 on weaker dollar but fresh bulls need more evidence to signal reversal

Spot gold regained traction after last week’s sharp post-Fed fall and bounced above key $1800 level.

Recovery from new 1 ½ month low ($1780) extends into second day, driven by weaker dollar, as traders collected profits after euphoria on Fed’s hawkish signals for first rate hike in March and subsequent 3-4 increases until the end of the year faded, and more cautious tones were heard from the US policymakers.

Fed remains on course to end pandemic measures and start tightening policy as inflation skyrocketed, but also wants to keep the door open amid uncertain outlook and still ongoing pandemic.

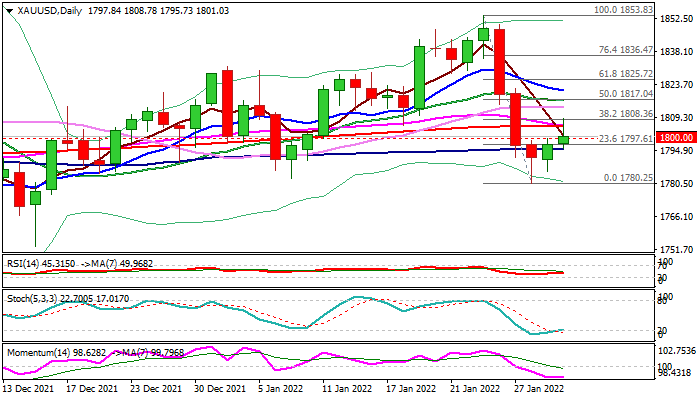

Fresh strength needs close above $1800 today to generate initial bullish signal, with extension above $1815/17 pivots (daily cloud top / 50% retracement of $1853/$1780 bear-leg) to confirm reversal.

Daily studies are still weak as 14-d momentum remains in the negative territory and moving averages remain above the price, with converged 55/200DMA’s on track to for a death-cross and add negative tone on technical outlook.

However, near-term action is expected to remain biased higher while holding above $1800, but the downside will remain vulnerable as long as the price action stays within the daily cloud ($1796/$1815), with more direction signals expected from Friday’s release of US non-farm payrolls for January.

Res: 1805; 1808; 1815; 1821

Sup: 1800; 1796; 1785; 1780