Holiday-thinned market and mixed signals keep the euro in extended narrow range trading

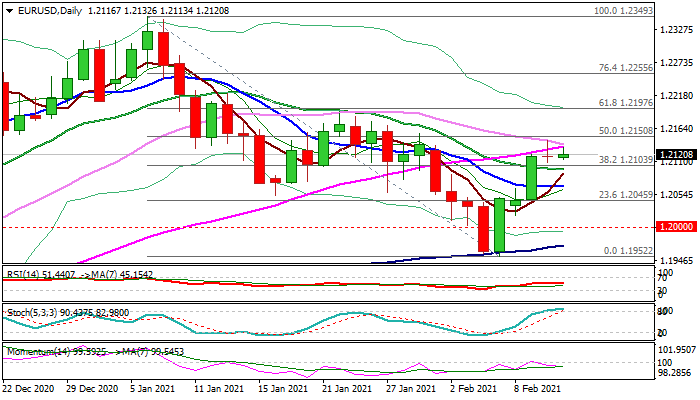

The Euro remains constructive in early Thursday’s trading after previous day’s action ended in Doji candle with long upper shadow, which signals indecision and that the rally of past three days might be running out of steam.

Lower volumes on major Asian markets being shut for holidays, keep the pair within a narrow range.

Conflicting studies do not provide much of direction signals as daily techs maintain negative momentum, stochastic is overbought and moving averages are in mixed setup.

On the other side, weak US inflation data softened dollar, along with dovish comments from Fed chief Powell, who confirmed that ultra-low policy is likely to stay in place for extended period of time.

Near-term price action is holding above pivotal supports at 1.2103/1.2096 (broken Fibo 38.2% / 20DMA), close below which would provide initial bearish signal, with return below 10DMA (1.2069) to bring bears in play.

Conversely, break and close above converging 55/30 DMA’s (1.2134/38) and Fibo 50% of 1.2349/1.1952 (1.2150) would generate positive signal for continuation of recovery leg from 1.1952 (Feb 5 base) and attack at daily cloud top (1.2200).

Res: 1.2138; 1.2150; 1.2189; 1.2200

Sup: 1.2103; 1.2069; 1.2046; 1.2019