Increase in risk-aversion indicators in the US stock markets due to the rapid growth of inflation

With the rapid inflation, risk-aversion indicators have increased in the US stock markets. Given that the FOMC’s hawkish monetary policies are likely to tighten, the possibility of lower demand for equity markets has increased in the mid-term.

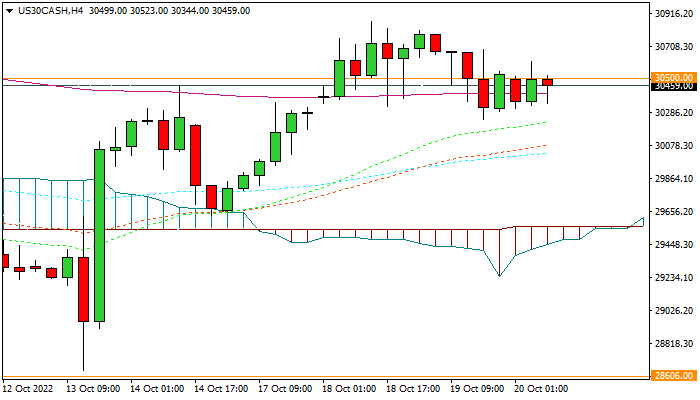

In addition, the market’s reaction to companies’ financial reports has been limited in recent days, and the Dow Jones index has not been able to cross the 34-day resistance range.

Technically, after the bullish corrective trend, the index has reached the resistance range of 30500 and is moving in a side trend. Therefore, in the mid-term, the first possibility will be to return to the bearish trend. In this scenario, the major support level of 28,600 is against the downward trend, considered the lowest range in the last two years. Crossing this level can increase the expectation of the index’s descent to the 26,000 level in the mid-term.