High possibility of Japanese government intervening in FX market as the JPY value hits its lowest level since 1990

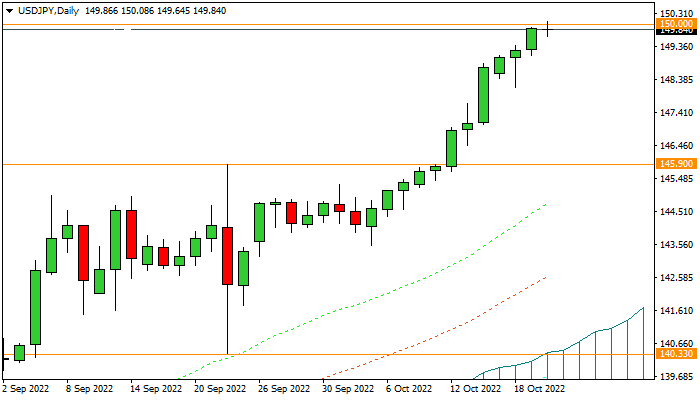

Despite the intervention of the Central Bank of Japan in the FX market last month to control the value of the Japanese yen, the price has returned to the bullish trend after a short-term correction and has now exceeded the previous peak and reached the major resistance range of $150, which is the lowest value of USDJPY since 1990. According to the statements of Kuroda (Governor of the Bank of Japan), regarding keeping a close eye on FX market moves, forecasts show that there is a possibility of the Japanese government’s intervention to control the value of the Yen and reduce the yield rate of bonds.

In this case, the possibility of a downward corrective trend of USDJPY in the current range will be strengthened. However, considering Japan’s monetary policy divergence from the US Federal Reserve, any intervention by the BOJ will probably have short-term results.

Technically, the value of the Japanese Yen against the USD has decreased by more than 47% in the last two years, the upward slope of the USDJPY price has increased in recent weeks, and the possibility of a short-term downward corrective trend has been strengthened. However, in the mid-term, the first possibility is continuing the bullish trend.