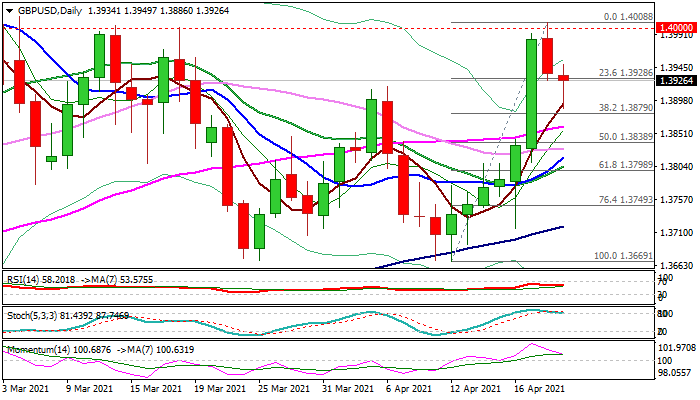

Key Fibo support limits two-day pullback

Cable extends pullback into second day following failure at psychological 1.40 barrier on Tuesday.

Sterling came under additional pressure after data showed that UK inflation rose below forecast, with return into daily cloud also triggering stops parked below cloud top (1.3941).

Fresh bears faced headwinds on approach to pivotal Fibo support at 1.3879 (38.2% of 1.3669/1.4008) and bounced back above 1.3900 level.

Renewed risk aversion keeps near-term action biased lower, with strong loss of positive momentum on daily chart and stochastic about to reverse from overbought zone, adding to negative tone, however larger bulls from 1.3669 (Apr 12 low) remain so far intact.

Limited dips (above 1.3879 Fibo support) would signal positioning for renewed attack at key 1.4000/20 barriers (psychological / Fibo 61.8% 1.4238/1.3669), but return and close above cloud top is required to confirm scenario.

Res: 1.3941; 1.3956; 1.4000; 1.4020

Sup: 1.3879; 1.3861; 1.3838; 1.3816