Larger bulls likely to resume after consolidation

The USDJPY is standing at the back foot in European trading on Thursday, following a mild reaction on the outcome of BoJ policy meeting, earlier today.

The Bank of Japan kept ultra-easy policy as expected, with short-term interest rate target remaining around -0.1%.

BoJ expects the economy to eventually pick up as pandemic impact subsides, while the outlook for the fiscal 2021/22 being revised lower to 3.4% from previous forecast at 3.8% in July, but outlooks remain within expected parameters.

Dovish stance from the central bank and Governor Kuroda’s remark that recent yen weakness is good for Japanese investors, adds to expectations for further dollar’s rise against the Japanese currency.

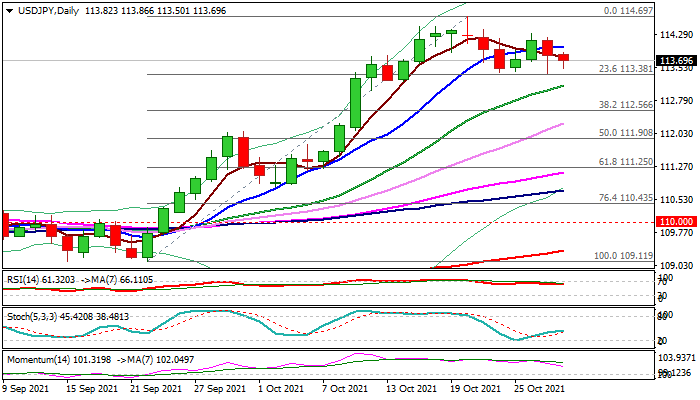

The pair is currently consolidating after two-month rally from 109 zone hit new 4-year high at 114.69 on Oct 20, with solid supports at 113.40/10 zone (consolidation range floor / Fibo 23.6% of 109.11/114.69 / rising 20DMA) expected to hold and keep larger bulls intact for fresh push higher and renewed probe through key resistances at 114.60 zone (Fibo 76.4% of 118.66/101.18 / 2017 peaks).

Caution on break below 113.40/10 pivots that would complete a failure swing pattern on daily chart and risk deeper pullback towards next key support at 112.56 (Fibo 38.2% of 109.11/114.69).

Res: 113.99; 114.31; 114.60; 114.73

Sup: 113.40; 113.10; 112.56; 112.25