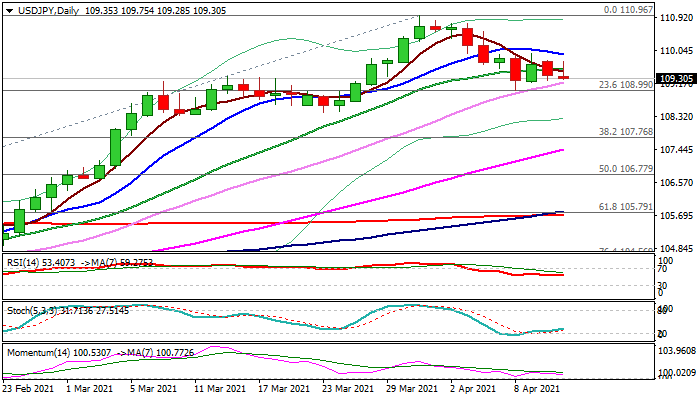

Larger bulls to remain intact above pivotal Fibo support

The pair stands at the back foot in early Tuesday’s trading, but near-term action remains within congestion that extends into fourth consecutive day.

Pullback from new one-year high at 110.96 (Mar 31) found footstep at 108.99 (Fibo 23.6% of 102.59/110.96), reinforced by rising 30DMA that eased downside pressure and keeps in play hopes of fresh advance while the price remains above this level.

Lift above 10DMA (109.93) is needed to signal higher low (108.99) and open way for recovery, while extended sideways mode but with existing downside risk, could be expected while 10DMA caps.

Bearish scenario sees possibilities of a deeper correction of four-month 102.59/110.96 rally on firm break of 108.99 Fibo support and a higher low of Mar 23 at 108.40.

US inflation data and speeches of a number of FOMC members are key events for dollar today and expected to provide fresh direction signals.

Res: 109.55; 109.93; 110.21; 110.55

Sup: 109.19; 108.99; 108.40; 107.76