Lira looks for further weakness after Monday’s 2% fall on rising geopolitical tensions

The pair is consolidating after rallying 2% on Monday, as Turkish lira was hit strongly by President Trump’s warning that the US would hurt badly Turkey’s economy if they take a military action in northeast Syria after US troops pull out from the area.

Lira’s fall on Monday was the third biggest one-day loss in 2019.

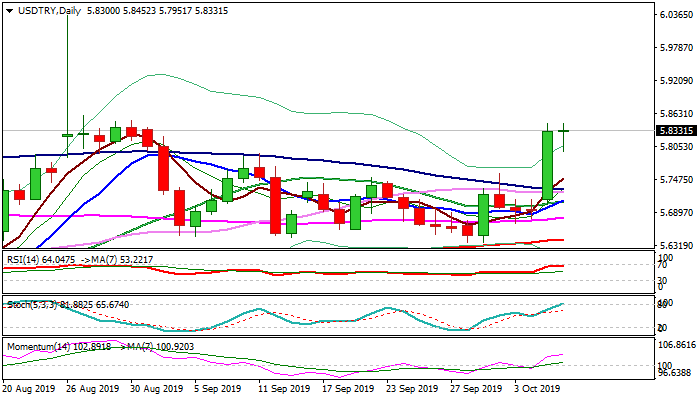

Short-term focus shifted higher after a month-long consolidation stayed above rising 200DMA (currently at 5.6420) and subsequent rally broke above a cluster of barriers, provided by daily MA’s and emerged above daily cloud.

Fresh advance from the higher base formed at 5.64 zone pressures barrier at 5.8470 (50% retracement of 6.2445/5.4494), break of which would expose targets at 5.90/94 and could extend towards psychological 6.00 barrier, if situation escalates.

Daily techs maintain strong bullish momentum , with significant bullish signals developing on weekly chart (momentum broke into positive territory and stochastic turned north just above oversold zone border.

Broken converged 100/30DMA’s (5.7286/44) mark solid support which needs to hold dips and keeps bullish bias.

Res: 5.8470; 5.9000; 5.9408; 6.0000

Sup: 5.7951; 5.7574; 5.7286; 5.7104