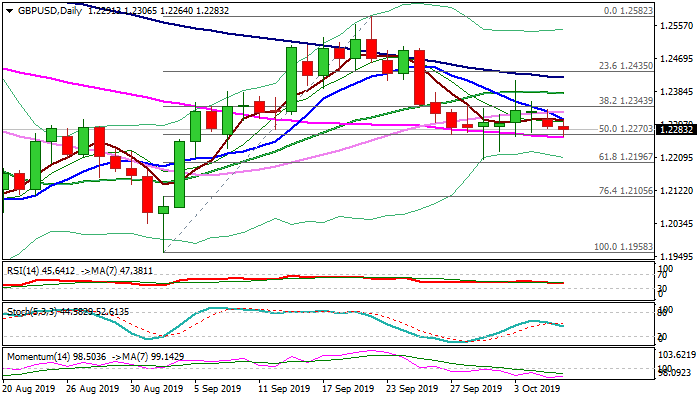

Pivotal support at 1.2270 tested again as Brexit pessimism weighs

Early Tuesday’s action stays in red and hit new low at 1.2264 (the lowest since 2 Oct) on probe through 1.2270 pivot (daily Kijun-sen / 50% retracement of 1.1958/1.2582 upleg).

Monday’s upside rejection and close in red after Friday’s long-legged Doji, signals fresh weakness, as sentiment soured on rising pessimism that UK and EU can reach a deal before 31 Oct and skip disorderly Brexit (the latest reports show bets of less than 10% for divorce with deal).

Also, source from Downing Street said this morning that the UK will leave the union without a deal if the EU does not compromise.

Rising bearish momentum, south-heading stochastic and MA’s in bearish setup on daily chart, add to negative outlook.

Firm break of 1.2270 would spark fresh weakness and expose pivotal supports at 1.2204 and 1.2196 (1 Oct spike low / Fibo 61.8% of 1.1958/1.2582).

Falling 10DMA (1.2308) caps today’s action and marks initial barrier, guarding 30DMA (1.2326) and broken Fibo 38.2% (1.2343) break of which would ease downside pressure and expose upper pivots at 1.2370/77 (daily cloud top / 20DMA).

Res: 1.2308; 1.2326; 1.2343; 1.2370

Sup: 1.2270; 1.2264; 1.2226; 1.2204