Lira rises strongly as geopolitical situation prompts traders into high-yielding and cheap assets

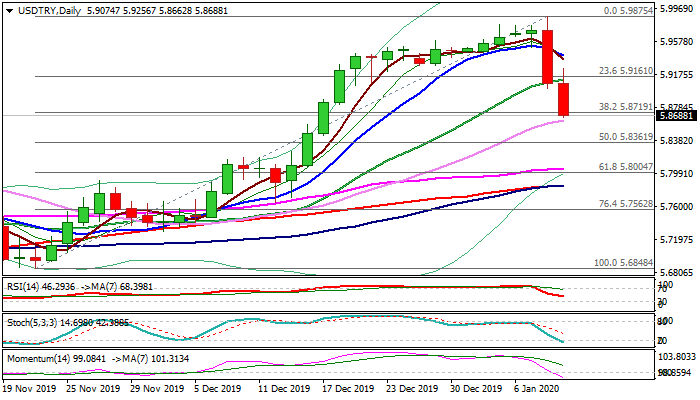

The pair extends steep fall from new multi-month high at 5.9875 into second straight day (down 1% on Wednesday and 0.6% so far today) and cracked important support at 5.8719 (Fibo 38.2% of 5.6848/5.9875).

Massive Wednesday’s bearish daily candle (the biggest one-day fall since 23 Oct) weighs heavily, with further bearish signal expected on close below 5.8719 Fibo support.

In such scenario, the way would be opened for test of 5.80 zone (Fibo 61.8%).

Rising daily bearish momentum and signals that the pair is on track for the first bearish weekly close in seven weeks, adds to negative outlook.

Fragile geopolitical situation works in favor of Turkish lira, which is cheap and less risky and also provides solid return on high interest rates in Turkey (12%).

Res: 5.8719; 5.9000; 5.9161; 5.9269

Sup: 5.8605; 5.8587; 5.8361; 5.8000