Monday’s action was so far shaped in long-legged Doji, signaling indecision

Cable fell around 85 pips in mid-European session on Monday after being hit by latest Brexit comments, as PM May said she doesn’t want to extend post Brexit transition period.

May wants transition to be completed before national election in May 2022.

Another negative signals for pound come from EU parliament official who said draft Brexit deal will not be renegotiated and rising number of those who show no confidence in PM May.

Cable shows indecision ahead of beginning of US session as Monday’s action was so far strongly rejected on both sides.

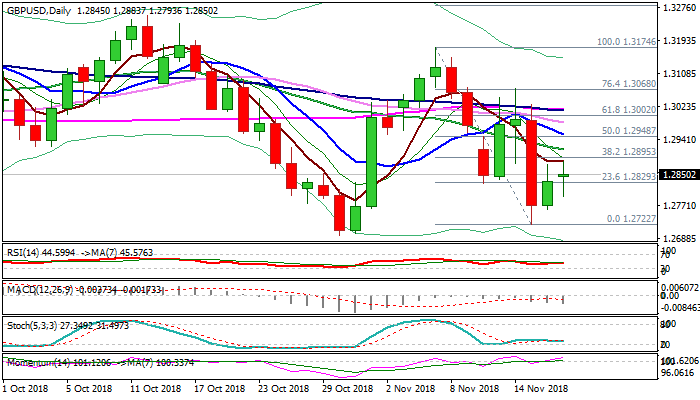

Strong bullish momentum underpins and keeps the downside protected for now, but upside attempts remain limited under key Fibo barrier at 1.2895 (38.2% of 1.3174/1.2722 bear-leg) as falling daily MA’s in bearish setup weigh.

Near-term action remains volatile and looking for fresh news about Brexit, pair’s recent key driver, to generate fresh direction signal.

The downside is expected to remain vulnerable while recovery attempts lack strength for stronger advance and would keep risk of retesting 1.2722 (last week’s low, posted on Thursday) and 1.2695 (30 Oct low) loss of which would expose key med-term support at 1.2661 (2018 low, posted on 15 Aug).

On the other side, sustained break above 1.2895/1.2915 pivots (Fibo 38.2% / falling 20SMA) would provide relief.

Res: 1.2883; 1.2895; 1.2915; 1.2948

Sup: 1.2829; 1.2793; 1.2760; 1.2722