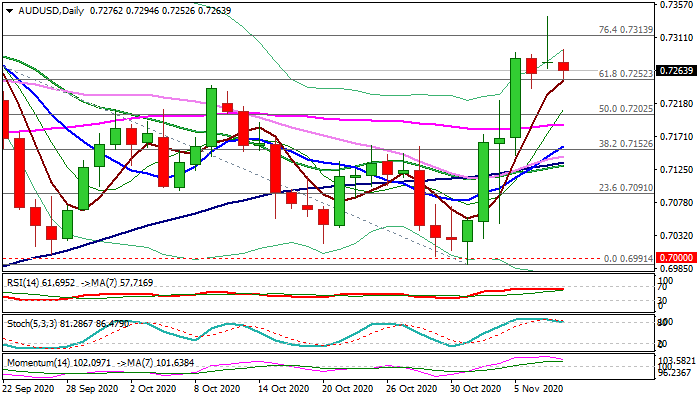

Narrow consolidation above daily cloud top to precede fresh push higher

The Australian dollar holds in sideways mode for the third day, consolidating 3.3% rally from 0.6991 (2 Nov low).

Underlying bulls remain in play, boosted by bullish engulfing on weekly chart, close above 200WMA (0.7242), as well as formation of bullish engulfing on monthly chart.

Monday’s strong upside rejection and inverted hammer candle on daily chart, warn of extended consolidation / pullback, as bullish momentum is weakening and daily stochastic is about to reverse from overbought zone.

Balanced risk keeps the consolidation within a narrow range, with extended dips to find solid ground at 0.7200 zone (Fibo 38.2% of 0.6991/0.7340 upleg / daily cloud top) and keep bulls in play for renewed probe through 0.7300 barrier, as Monday’s spike approached initial target at 0.7345 (16 Sep high).

Sustained break here would open way towards key barrier at 0.7413 (1 Sep peak) the highest since Aug 2018).

Res: 0.7294; 0.7313; 0.7345; 0.7381

Sup: 0.8239; 0.7200; 0.7165; 0.7124