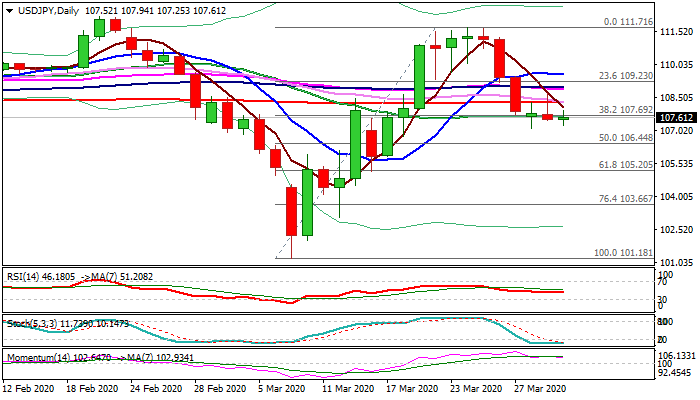

Negative signal on repeated close below Fibo support/20DMA at 107.69

The pair is holding in directionless mode but below broken pivotal Fibo support at 107.69 (38.2% of 101.18/111.71 upleg, reinforced by 20DMA) following eventual close below here that generated bearish signal.

Tuesday’s strong upside rejection left bearish daily candle with long upper shadow, which adds to negative signals.

Daily MA’s turned to full bearish and formed multiple bear-crosses setup and along with fading bullish momentum weigh on near-term action, although partially offset by flat RSI and oversold stochastic.

Repeated close below 107.69 would reinforce negative stance, but extension and close below weekly cloud base (107.44) is needed to confirm signal and expose next strong support at 106.44 (50% of 101.18/111.71 / daily Kijun-sen).

Res: 107.69; 108.29; 108.97; 109.23

Sup: 107.25; 107.12; 106.75; 106.44