Oil loses traction on China’s Covid measures; weak economic data

WTI oil starts week in red, dropping 2.1% in early Monday’s trading, as sentiment was soured by weak China’s manufacturing data and widening Covid restrictions, threatening of slower demand from the world’s second largest economy and world’s biggest oil importer.

Concerns about global economic slowdown on soaring inflation and aggressive rate hikes by world’s major central banks, add to negative signals.

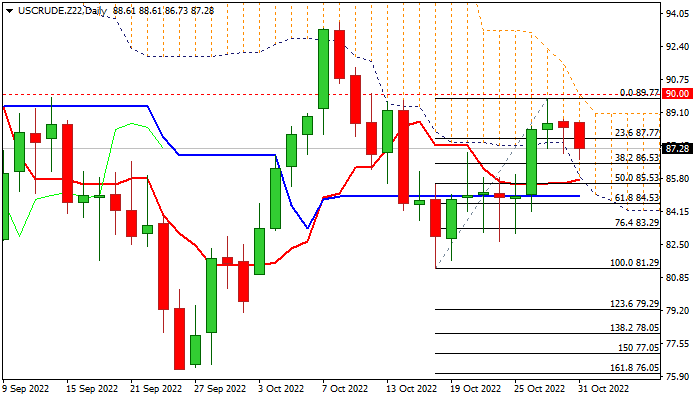

Fresh weakness emerges after a double failure at pivotal Fibo barrier at $88.90 (61.8% of $93.60/$81.29), which guards psychological $90 barrier, but still lacking stronger bearish signals, which could be expected on violation of supports at $85.91 (daily cloud base) and $85.74 (daily Tenkan-sen).

Daily studies are mixed, as momentum is heading north but still in the negative territory, while MA’s are in bullish setup.

Failure to clear pivotal supports at $85.91/74 would keep near-term action within a consolidative range and bias with bulls, while sustained break above $90 remains a trigger for further advance.

Bearish scenario sees break of $85.91/74 pivots as a trigger for deeper fall, which could target $83.00 zone.

Focus will remain on economic data, which are nowadays oil’s key drivers.

Res: 88.90; 89.77; 90.00; 90.69

Sup: 86.66; 85.91; 85.74; 85.05