Oil price extends weakness on renewed demand fears

The WTI oil extends weakness on Wednesday, following nearly 6% fall on Tuesday, hitting one week low.

The sentiment soured on renewed concerns about global demand, following a rebound in Covid cases and new lockdowns in China, world’s top oil importer.

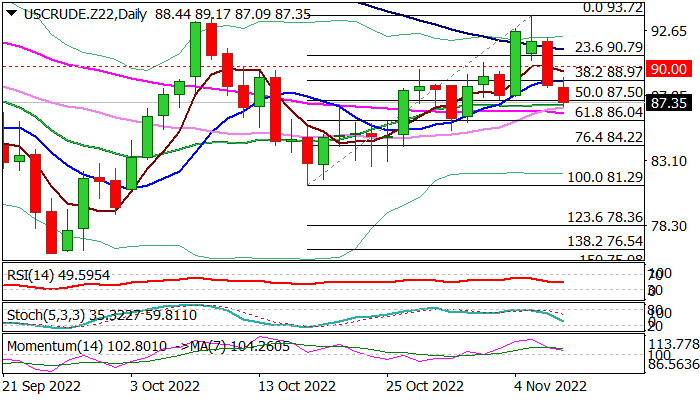

Fresh weakness, after bulls got repeatedly trapped above Fibo 76.4% of $97.62/$76.25 ($92.58), dipped well below psychological $90 support, retracing over 50% of $81.29/$93.72 upleg that weakened near-term structure and started to shift near-term focus lower.

Daily studies show strong loss of bullish momentum that contributes to negative outlook, though 14-d momentum indicator is still in positive territory, suggesting that fresh bears would need more evidence for confirmation.

Extension through diverged 20/55 DMA’s ($87.02/$86.58) and pivotal Fibo level at $86.04 (61.8% of $81.29/$93.72) would add to negative signals and increase downside risk.

Near-term action needs to stay below broken Fibo 38.2% level at $88.97 to keep bearish stance, while $90 level marks the upper pivot, violation of which would sideline bears.

Res: 88.97; 90.00; 90.79; 91.26

Sup: 87.02; 86.58; 86.04; 85.28