Positive tone above daily cloud base ahead of key German / EU data

The Euro stands at the front foot in early Tuesday’s trading and pressures initial barriers at 1.1246/47 (falling 5SMA / Monday’s high).

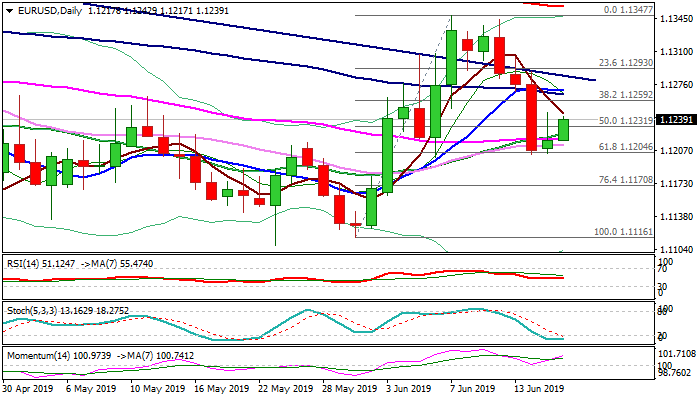

The pair is attempting to form a base at key supports at 1.1208/04 (daily cloud base / Fibo 61.8% of 1.1116/1.1347) which contained Friday’s strong fall and Monday’s action.

Bears off 1.1347/43 double-top are on hold, as bullish momentum is rising and stochastic reversing in oversold territory on daily chart.

Extended upticks need to stay below pivotal barriers at 1.1265/69 (converged 100/10SMA’s) and 1.1279 (daily cloud top) to keep in play hopes for renewed attack at 1.1208/04 pivots and possible bearish continuation on firm break.

Lift and break above daily cloud top would neutralize bears and shift focus higher.

Series of key data from EU and speech of ECB President Draghi are due today and eyed for fresh signals.

German ZEW (Jun -5.7 f/c vs -2.1 prev) and EU CPI (May m/m 0.2% f/c vs 0.7% prev; y/y 1.2% f/c unchanged) would sour the sentiment on weak releases.

Res: 1.1247; 1.1269; 1.1279; 1.1289

Sup: 1.1224; 1.1217; 1.1208; 1.1202