Post-US election rally faces strong headwinds at 1.3200 zone; focus turns to EU-UK talks

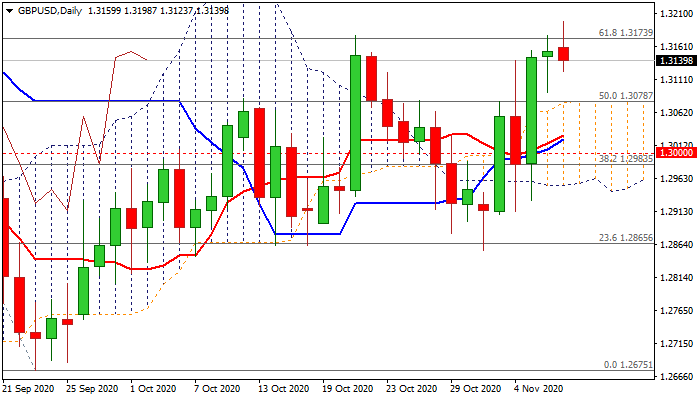

Cable hit new two-month high (1.3198) in early Monday’s trading, lifted by fresh risk mode after Democrat Joe Biden announced victory, but rally was so far short-lived, as traders collected profits after bulls probed above pivotal resistances at 1.3173/77 (Fibo 61.8% of 1.3482/1.2675 / 21 Oct peak) and faced headwinds at psychological 1.3200 barrier.

Last week’s 1.8% advance (the biggest weekly rally since late Aug) points to positive sentiment and massive weekly candle underpins near-term action, but Friday’s Doji, fading bullish momentum and overbought stochastic on daily chart, warn of deeper pullback.

The action is underpinned by thickening daily cloud, with cloud top (1.3178) expected to contain dips and keep in play dip-buying scenario for fresh attempt at key 1.3170/1.3200 resistance zone.

Caution on break of pivotal supports at 103078/67 (cloud top / Fibo 38.2% of 1.2855/1.3198 upleg) which would put bulls on hold and risk deeper fall towards psychological 1.30 support.

Traders focus on crucial week of EU-UK trade talks which resume today, with risk of stronger weakness if two sides fail to agree, while stronger bullish acceleration could be anticipated on signs of deal.

Res: 1.3177; 1.3200; 1.3253; 1.3292

Sup: 1.3117; 1.3092; 1.3078; 1.3067