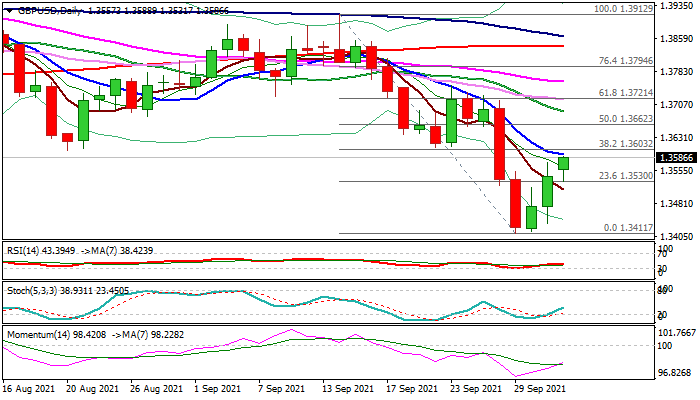

Recovery extends into third straight day and pressures pivotal barriers at 1.36 zone

Fresh bulls from new nearly ten-month low (1.3411) hold grip for the third straight day and crack pivotal 1.1.3570/1.3600 resistance zone (former lows of July/Aug / daily Tenkan-sen / Fibo 38.2% of 1.3912/1.3411).

Renewed risk appetite keeps pound afloat in the neat term, however, firm break above 1.36 zone barriers is needed to sideline larger bears and allow for stronger correction.

Improving daily studies (momentum is running north, stochastic reversed from negative territory) support the action, while Friday’s daily cloud twist could be also magnetic.

Close above 1.3600 zone would generate bullish signal and expose next pivot at 1.3662 (daily Kijun-sen / 50% retracement) which guard key barriers lay at 1.3721 (Fibo 61.8% of 1.3912/1.3411) and 1.3750 (weekly cloud top).

Failure to clear 1.3662 would signal that recovery loses traction and increase risk of stall.

Res: 1.3603; 1.3662; 1.3690; 1.3721

Sup: 1.3530; 1.3512; 1.3433; 1.3411