Renewed rate hike hopes keep sterling afloat

Cable edged higher on Thursday, following a limited pullback previous day, remaining inflated by improved global risk sentiment.

The Bank of England said that the size and duration of a recent jump in inflation is greater than expected, driven by fading negative impact from the pandemic and normalization of global supply and demand, but interest rates are likely to remain low in coming years.

Market analysts however, believe that the prospects for rate hike improved and expect a 15 basis points hike in December and further increases in 2022.

Sterling found a footstep at 1.3400 zone after erasing all gains in the first six months of 2021, with fresh optimism about earlier than expected rate hike, expected to keep the currency supported.

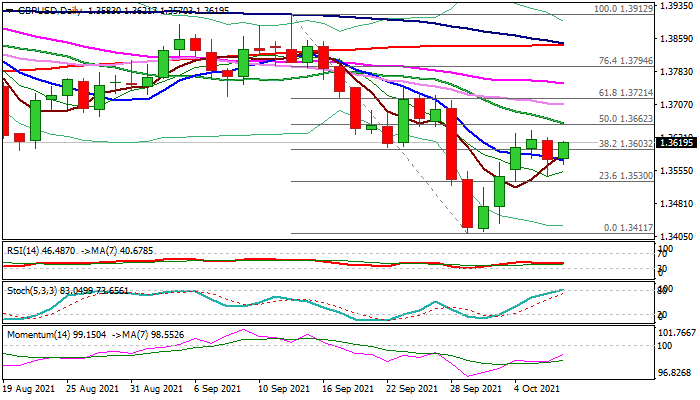

On the other side, technical studies on daily chart have improved, but still require verification on extension and close above pivotal resistance at 1.3662 (daily Kijun-sen / Fibo 38.2% of 1.3912/1.3411 descend / weekly Tenkan-sen).

Further strong bullish signal could be expected on break of next key barriers at 1.3731/50 (Fibo 38.2% of entire 1.4292/1.3411 pullback / weekly cloud top).

Repeated close above 10DMA (1.3578) is need to keep near-term bias with bulls.

Res: 1.3631; 1.3647; 1.3662; 1.3707

Sup: 1.3578; 1.3557; 1.3530; 1.3501