Reversal pattern is forming on daily chart but outlook remains negative on expectations for more aggressive Fed

The Euro bounces in early Wednesday following announcement that ECB’s will hold an unscheduled and rare meeting regarding the turmoil in bond markets.

The ECB officials will discuss the problem of sharp rise of bond yields since the ECB signaled a series of rate hikes that widened the spread between German bond yields and those of more indebted southern EU member countries.

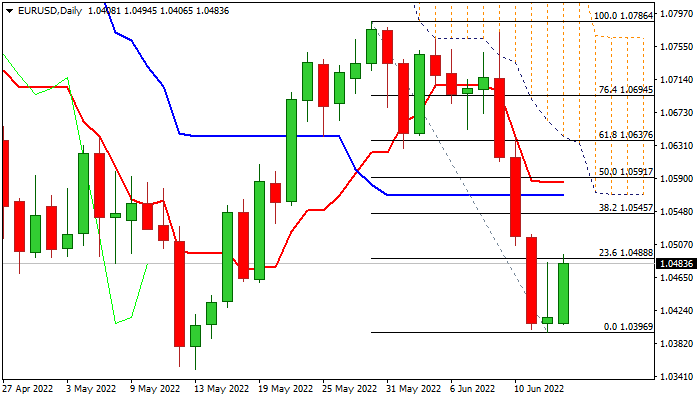

Sharp fall in past three days has formed a three black crows pattern which signals reversal, with Tuesday’s inverted hammer adding to signals, along with today’s advance.

Fresh bulls need close above minimum 1.05 level to complete reversal pattern, however, more upside action will be required to confirm reversal.

Daily RSI turned north, together with stochastic, which is deeply oversold, while negative momentum started to fade.

On the other side, daily studies are overall bearish and the action remains weighed by thick falling daily cloud, which, along with expectations for hawkish Fed tomorrow and fresh rise of the US dollar, points to limited correction before larger bears resume, with recovery to be likely capped by the base of daily cloud (1.0572).

Res: 1.0488; 1.0545; 1.0572; 1.0600

Sup: 1.0396; 1.0349; 1.0206; 1.0182