Rising inflation risks and geopolitical tensions continue lift gold

Spot gold rose to the highest in over one week on Monday as persisting geopolitical fears over Ukraine and mounting inflationary pressures boost demand for safe haven metal.

Hawkish stance of the US central bank with firmer signals about several rate hikes in 2022, so far did not obstruct demand for gold, used as a hedge against inflation and high risk situations, as higher rates increase cost of holding non-yielding yellow metal.

Investors turn their focus on US January inflation figures, due later this week, for more clues about Fed’s plans for raising interest rates.

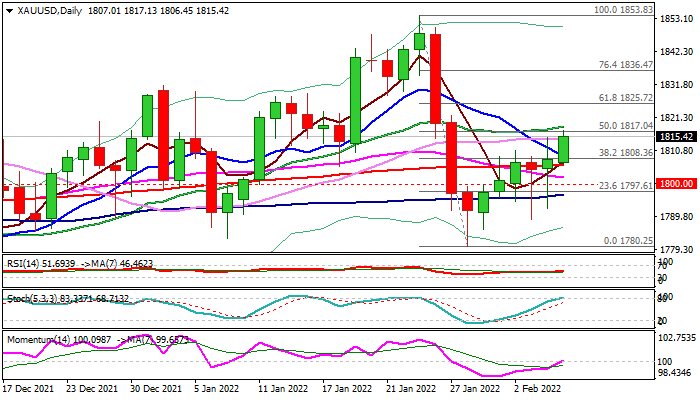

Extension of last week’s 1% advance cracked pivotal barriers at $1815/17 (daily cloud top / last week’s high / 50% retracement of $1853/$1780 fall), with firm break here to generate fresh bullish signal for further gains.

Improving daily studies (14-d momentum is about to break into positive territory / golden-cross of 5/200DMA’s is forming) support the action, with repeated close above 200DMA ($1806) to add to positive signals.

Alternative scenario sees initial negative signal on failure to hold gains above 200DMA, while drop below $1800 will be bearish.

Res: 1816; 1822; 1825; 1830

Sup: 1809; 1806; 1800; 1796