Risk appetite inflates pound; Tuesday’s UK PMI data in focus for fresh signals

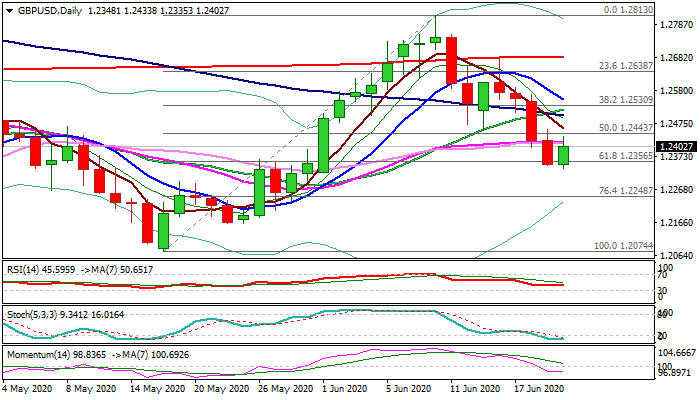

Bears pause above the top of daily cloud after falling 1.4% last week, as risk-sensitive sterling advance on fresh risk appetite on Monday.

Recovery attempts were so far limited by converged 30/55DMA’s (1.2420) as momentum remains negative on daily chart and moving averages are in bearish configuration, but oversold stochastic partially offsets pressure.

Friday’s marginal close below Key Fibo support at 1.2356 (61.8% of 1.2074/1.2813) was bearish signal as daily cloud is currently thin but will start to thicken and descend further on Wednesday.

Narrow consolidation before bears continue could likely near-term scenario, however, markets focus on Tuesday’s release of UK PMI data which could inflate pound on better than expected releases.

Recovery needs break above 1.2500/20 zone to signal reversal and neutralize existing downside risk.

Res: 1.2420; 1.2460; 1.2501; 1.2520

Sup: 1.2356; 1.2335; 1.2304; 1.2245