Sterling extends weakness after strong earnings data failed to spark stronger recovery

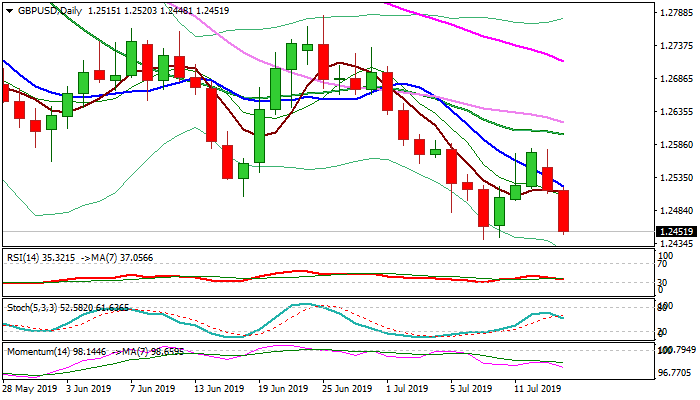

Cable extends weakness below 1.25 handle on Tuesday and pressures key support at 1.2439 (9 July low, the lowest since 3 Jan).

The price showed mild reaction on UK jobs data as earnings rose in May (3.4% vs 3.1% prev and 3.2% f/c) in the fastest rise in more than a decade, but jobless claims jumped to 38K in June from 24.5K previous month and also dipped well below forecast at 18.9K.

Employment also slowed (28K in three months to June vs 45K f/c and 32K prev), helping in offsetting positive signals from upbeat earnings data.

Adding to negative picture was radical stance of Boris Jonson, the front runner to replace Theresa May in the position of UK Prime Minister, over Brexit’s key points, Irish backstop.

Negative environment is also boosted by bearish daily studies which maintain strong negative momentum, as all indicators are in firm bearish setup and setting scope for eventual probe through 1.2439 pivot.

Sustained break here would open way towards 2019 low at 1.2397 (3 Jan spike low) and increase risk of revisiting key 1.20 support zone, tested after Brexit vote in 2016.

Former low at 1.2505 (18 June) marks initial resistance, with falling 10SMA (1.2521) expected to cap upticks and keep bears intact.

Res: 1.2505; 1.2521; 1.2559; 1.2579

Sup: 1.2437; 1.2397; 1.2353; 1.2300