Sterling falls further after Powell downplayed negative interest rates

Cable dropped to the session low at 1.2224 after Fed chief Powell pointed to gloom economic situation and possible need for further measures, but negative interest rates were not considered this time that inflated US dollar.

Fresh optimism over better than feared UK GDP data that lifted sterling, proved to be short-lived.

Brief probe above daily cloud top ended quickly and pound returned fully to red.

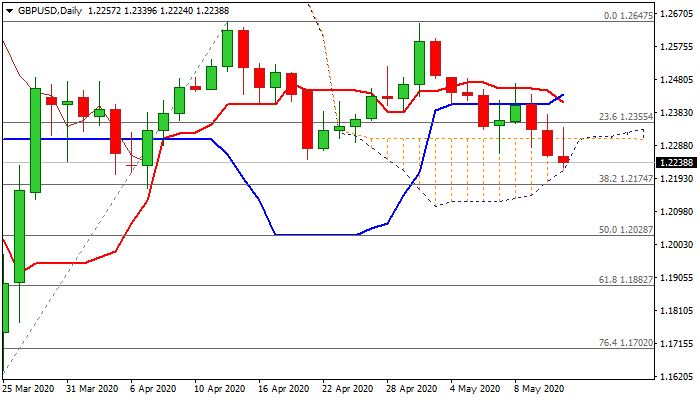

Bears pressure daily cloud base (1.2217) break of which would expose key supports at 1.2174/64 (Fibo 38.2% of 1.1409/1.2647 / 7 Apr low) and generate initial double-top reversal signal on close below these levels.

Bearish daily techs contribute to the picture along with weak fundamentals as Britain extends lockdown, with historic damages to the economy and persisting concerns about UK/EU Brexit talks.

Near-term bias is expected to remain with bears as long as price action stays below the top of thinning daily cloud (1.2309).

Res: 1.2309; 1.2339; 1.2355; 1.2377

Sup: 1.2217; 1.2200; 1.2174; 1.2164