Sterling loses traction despite strong data, dragged by weaker euro

Sterling fell across the board on Friday, weighed down by weakness of Euro, as new lockdowns in Europe on surging coronavirus cases soured the sentiment.

Austria will start a lockdown on Monday with high possibility that Germany would follow and rising uncertainty dampening risk mode.

Pound’s reaction on upbeat UK retail sales data (Oct 0.8% vs 0.5% f/c and Sep -0.2%) was minor, while positive impact from strong inflation figures is also fading.

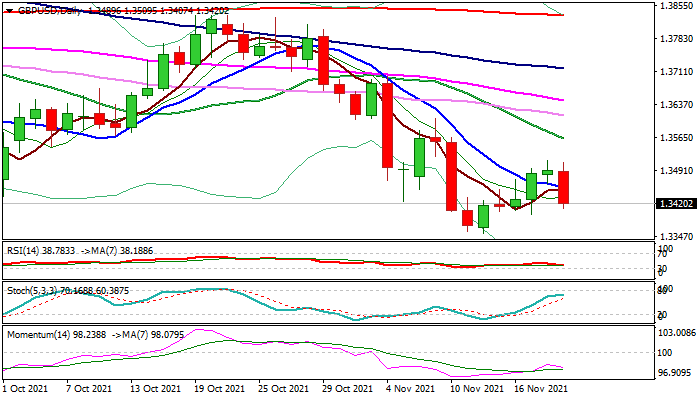

Cable was down 0.5% in European trading on Friday and fresh weakness so far retraced 61.8% of 1.3353/1.3513 upleg, suggesting that short recovery phase off 1.3353 low might be over.

Momentum indicator on daily chart turned south again, while being deeply in the negative territory that reinforces negative near-term stance and keeps in play risk of continuation of larger downtrend from 1.4249 (June 1 peak) and attack at 100WMA (1.3285) and weekly cloud base (1.3244).

Near-term bias is expected to remain with bears while the action stays capped under 1.3500.

Res: 1.3452; 1.3475; 1.3513; 1.3561

Sup: 1.3407; 1.3391; 1.3353; 1.3300