Strong rebound looks for confirmation on break of pivotal Fibo barrier

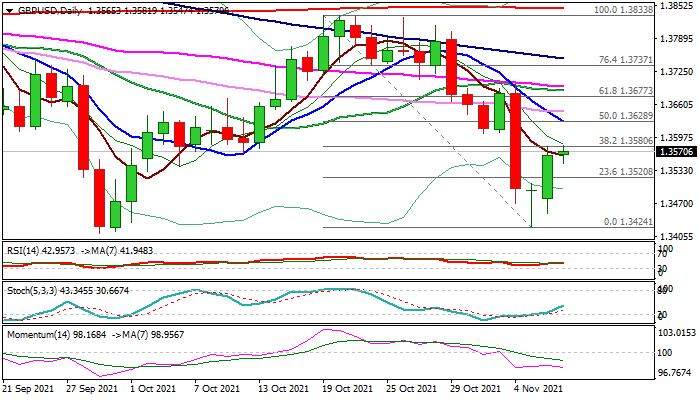

Cable is consolidating under pivotal Fibo barrier at 1.3580 (38.2% of 1.3833/1.3424) which capped Monday’s 0.63%advance.

Pound regained ground after strong fall last week, sparked by BoE surprise decision to stay on hold, despite many were expecting the first rate hike after pandemic.

Fresh strength was sparked by Monday’s hawkish comments from Governor Bailey who said BoE will act on interest rates if inflation risks grow further.

Monday’s rebound formed reversal pattern on daily chart, which still looks for confirmation on firm break above 1.3580 pivot.

This would open way for recovery extension towards 1.3621/28 (daily cloud base / 50% retracement / 10DMA) and unmask a lower tops at 1.3692 (also converged 20/55DMA’s).

Daily structure slightly improved on latest rally, although studies are still in bearish setup that requires caution.

Repeated daily close below 1.3580 would be an initial warning, however, return below 1.3520 (broken Fibo 23.6%) would confirm recovery stall and bring bears fully to play.

BoE policymakers are due to speak later today and markets will focus on their remarks for fresh signals.

Res: 1.3580; 1.3628; 1.3677; 1.3692

Sup: 1.3547; 1.3520; 1.3500; 1.3450