Stronger dollar keeps euro at the back foot in early Tuesday’s trading

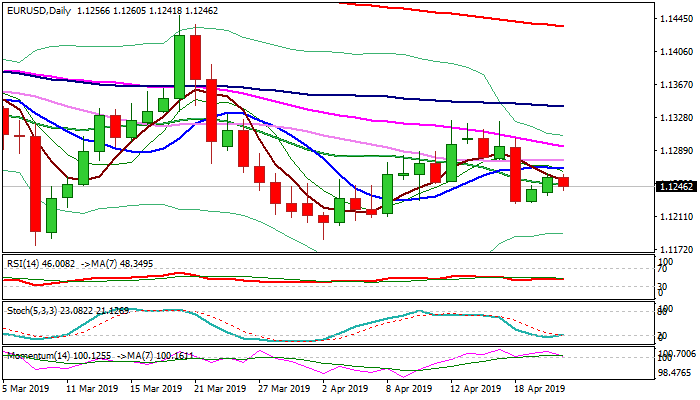

The Euro edged lower in early Tuesday’s trading, after two-day recovery stalled at 1.1260 zone, just ahead of 1.1263 pivot (Fibo 38.2% of 1.1323/1.1226).

The single currency came under pressure from broadly higher dollar in thin post-holiday trading.

The greenback regained traction after being hit by significant drop in US existing home sales on Monday, with release of US new home sales, being in focus today (Mar -3.0% f/c vs 4.9% prev).

Loss of bullish momentum keeps near-term action in red, but return and close below 20SMA (1.1248) is needed to confirm negative signal for retest of 1.1226 higher base.

Overall negative outlook is expected to persist while the price action holds below 30SMA (1.1276), which guards upper triggers provided by daily cloud base (1.1283) and 55SMA (1.1294).

Res: 1.1263; 1.1276; 1.1283; 1.1294

Sup: 1.1241; 1.1226; 1.1210; 1.1183