The dollar extends weakness, risks bigger fall

The dollar remains firmly in red and extends weakness into fourth consecutive day.

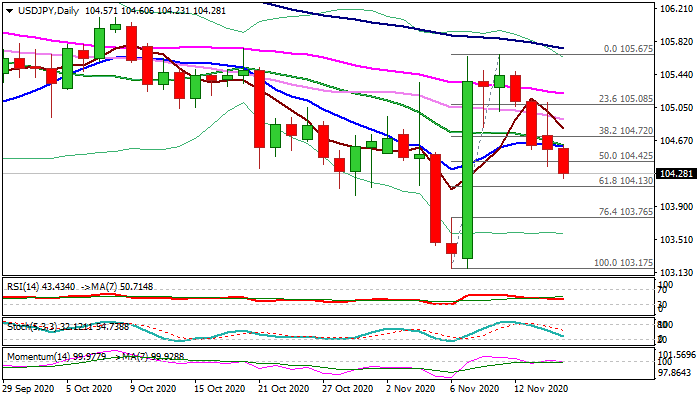

Bearish acceleration from 105.67 peak (11 Nov) so far retraced over 50% of 9 Nov massive rally, signaling further weakness.

Bears approach key Fibo support at 104.13 (61.8% of 103.17/105.67), following strong bearish signal on double daily close below pivotal support at 104.72 (Fibo 38.2%).

close below 104.13 would add to negative signals and increase risk of full retracement of 103.17/105.67 rally.

Falling daily MA’s in bearish configuration maintain pressure, with momentum entering negative territory.

Upticks towards 104.72, now reverted to strong resistance, are expected to offer better selling opportunities.

Res: 104.42; 104.60; 104.72; 104.91

Sup: 104.13; 104.00; 103.76; 103.17