The dollar holds firmly in red ahead of widely expected dovish Fed minutes

The dollar jumped on Wednesday, but gains proved to be short-lived and seen as positioning ahead of fresh push lower as the greenback remains firmly in red vs Japanese yen for the fifth straight day.

The sentiment soured on growing fears that Fed is not thinking of rate hike soon, as two key parameters – employment and inflation are still far from central bank’s targets that would keep ultra-loose policy in play for some time.

The US labor market remains fragile despite some encouraging signals and still far from full employment, while the Fed is not willing to risk and start tightening on initial signals of rising inflation, as they see current jump as transitory.

Investors focus the minutes from the Fed’s most recent meeting, due later today and widely expect the central bank to reiterate its dovish stance, but will carefully listen the comments from policymakers for signs of any potential earlier than expected action.

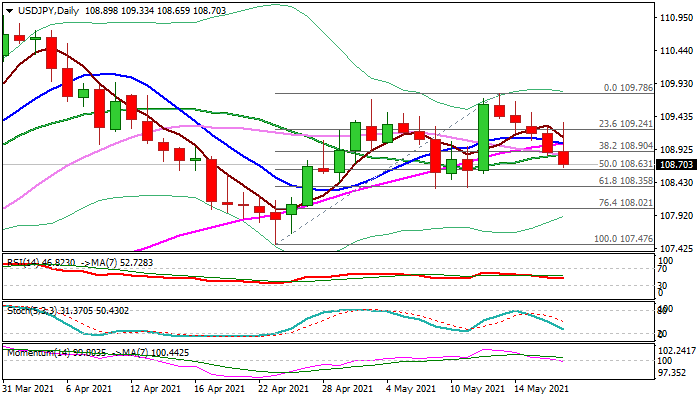

Fresh weakness broke below pivotal Fibo 38.2% of 107.47/109.78 upleg (108.90), signaling that bears – weighed by false break above the top of thick daily cloud and bull-trap above Fibo barrier at 109.63 (61.8% of 110.96/107.47) – are on course for further extension.

Falling 14-d momentum on daily chart entered negative territory and today’s fresh bearish acceleration below converged moving averages (10/20/30/55) add to negative near-term signals.

Today’s close in red with long upper shadow of daily candle, would confirm that bears hold grip for extension through 108.63 (50% retracement of 107.47/109.78) and test of key support at 108.35 (Fibo 61.8% / May 7/11 higher base).

Daily close below cracked 108.90 Fibo support is needed to confirm bearish near-term bias.

Res: 108.90; 109.02; 109.33; 109.50

Sup: 108.63; 108.35; 108.02; 107.64