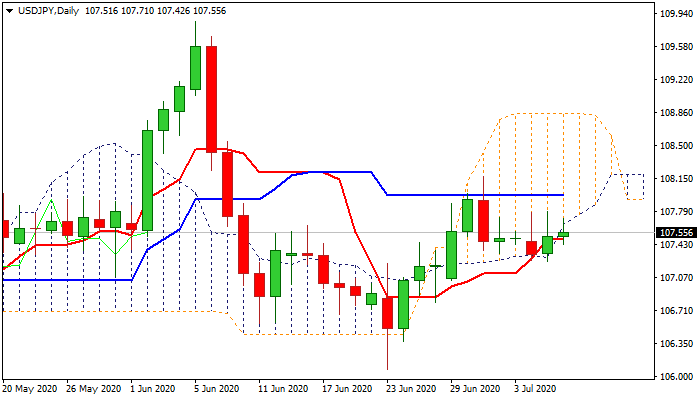

The downside is expected to remain at risk while daily cloud caps the action

The pair struggles to keep positive tone following the third consecutive upside rejection on Wednesday, as the today’s action capped by rising base of daily cloud.

Daily candles with long upper shadows (Mon/Tue) weigh on near-term action and add to negative signal from last week’s bull-trap above 50% retracement of 109.85/106.07.

The dollar remains fragile due to uncertainty over economic recovery and rising number of new Covid-19 infections.

Daily techs are mixed and lack firmer direction signal, but the downside is expected to remain at risk if today’s action closes below cloud base (107.65).

This would keep near-term risk skewed lower and expose pivotal supports at 107.36 (Fibo 38.2% of 106.07/106.16) and 107.25 (Mon/Tue lows / 20DMA).

Penetration and repeated close within daily cloud would sideline immediate downside risk, but lift and close above 107.70/80 zone is needed to neutralize and shift focus higher.

Res: 107.75; 107.94; 108.16; 108.36

Sup: 107.42; 107.25; 107.11; 106.87