Tight ranges ahead of ECB

The Euro holds in directionless mode for the second day, awaiting release of ECB’s policy review, due later today.

The single currency turned neutral on Wednesday and daily action ended in long-legged Doji, signaling indecision and looking for more signals from the ECB.

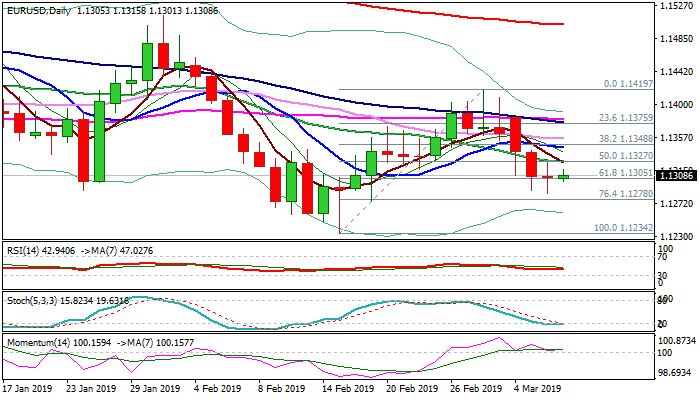

The pair repeatedly failed to close below 1.1305 pivot (Fibo 61.8% of 1.1234/1.1419) which could be seen as initial signal of stall of steep fall in past two days.

Daily studies are overall bearish but oversold stochastic and momentum still holding in positive territory add to basing signals.

Traders will focus on tone of ECB President Mario Draghi at the press conference which many expect to be dovish.

The central bank is expected to slash forecast and likely to signal fresh stimulus in the form of cheap loans to the banks, in attempts absorb negative impact from global economic slowdown, trade war fears and Brexit.

The ECB has signaled gradual rate hikes in the second half of 2019 after ending its stimulus program in December, but situation is changing and major central banks, led by US Federal Reserve start to reverse course and sideline planned rate hikes, due to current situation.

Risk of eventual clear break below 1.1305 pivot remains high and could be further boosted on dovish stance from the ECB.

That would expose Fibo support at 1.1278 (Fibo 76.4%) and risk extension towards key supports at 1.1234 (15 Feb) and 1.1215 (12 Nov).

Falling 20SMA (1.1326) which capped Wednesday’s action, marks initial barrier, break of which would sideline immediate downside risk.

Res: 1.1326; 1.1344; 1.1356; 1.1377

Sup: 1.1301; 1.1285; 1.1278; 1.1234