Upbeat German data lift Euro ahead of US jobs report

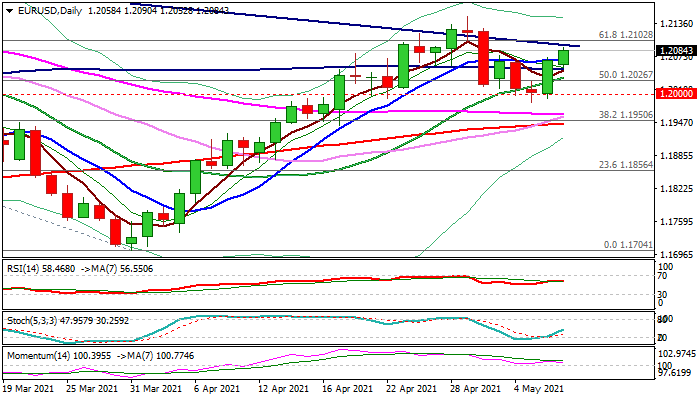

The Euro rose further in European trading on Friday, extending Thursday’s 0.52% rally which left the bear-trap at 1.20 support and shifted near-term focus to the upside.

Upbeat German data on Friday (manufacturing orders surged 29.5% in Mar from 6.4% in Feb) added to bullish near-term stance.

Fresh gains cracked pivotal Fibo barrier at 1.2087 (61.8% of 1.2149/1.1985 pullback) and pressure trendline resistance at 1.2094, with close above these levels to signal an end of corrective phase.

Bullishly aligned daily techs also support the action, but traders await the release of key US jobs data for April, which are expected to provide strong signal.

Forecasts for further increase in US hiring and lower unemployment signal that post-pandemic economic recovery is accelerating that would increase investor risk appetite and further lift the single currency.

Bullish scenario sees acceleration towards recent peak at 1.2149 (Apr 29), with break here to open way for 1.22+ gains.

Conversely, disappointing US figures would deflate risk sentiment and weaken near-term structure for fresh attack at key supports at 1.20/1.1973 (psychological / daily cloud top).

Res: 1.2094; 1.2126; 1.2149; 1.2197

Sup: 1.2067; 1.2047; 1.2033; 1.2000