Upbeat Manufacturing data inflate Euro but key barriers still intact

The Euro jumped on Friday after double rejection above daily cloud and Thursday’s close in red, lifted by impressive German Oct Manufacturing PMI (58.0 vs 55.1 f/c, the highest since May 2018) and solid European figures (Oct 54.4 vs 53.2 f/c) which offset negative readings in the services sector in October.

Better than expected numbers would temper the uncertainty as overall bloc’s economic picture remains grim, as strong rise in new coronavirus infections threatens to further slow fragile economic recovery.

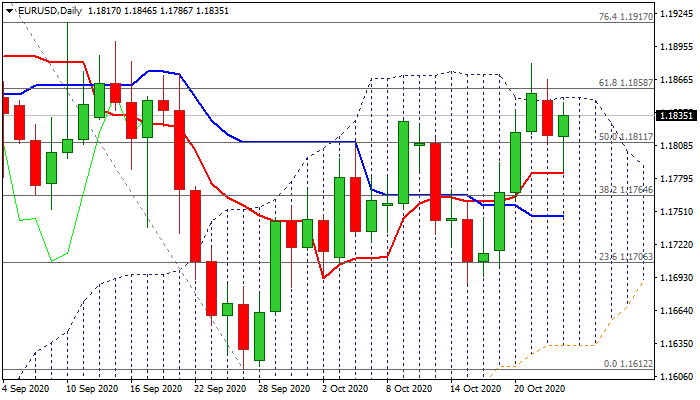

Repeated failure to clearly break through key obstacles at 1.1850/58 (daily cloud top / Fibo 61.8% of 1.2011/1.1612 fall) weighs on near-term action, with fading bullish momentum on daily chart and stochastic turning south after touching the overbought zone border, adding to fears of stall.

Bulls need lift and weekly close above these barriers to resume recovery rally from 1.1212 (25 Sep low) and open way towards 1.1917 (Fibo 76.4%), with cracked psychological 1.20 barrier expected to come in focus again after initial attack in early September failed.

Alternatively, repeated upside rejection would mark the third consecutive failure and increase risk of pullback.

Solid support lays at 1.1795 (55DMA), guarding 1.1764 pivot (20DMA / broken Fibo 38.2%) loss of which would confirm reversal.

Res: 1.1850; 1.1858; 1.1880; 1.1917

Sup: 1.1811; 1.1795; 1.1781; 1.1764