US Stock markets in corrective upward trend, despite expectations for a 0.75 to 1 percent increase in interest rate

Two weeks left until the FOMC meeting and the possible increase of 0.75 to 1 percent of the interest rate, the US stock markets are fluctuating in an uptrend. Meanwhile, CPI data has supported interest rate hikes to control inflation, which could decrease the demand in stock markets in the mid-term.

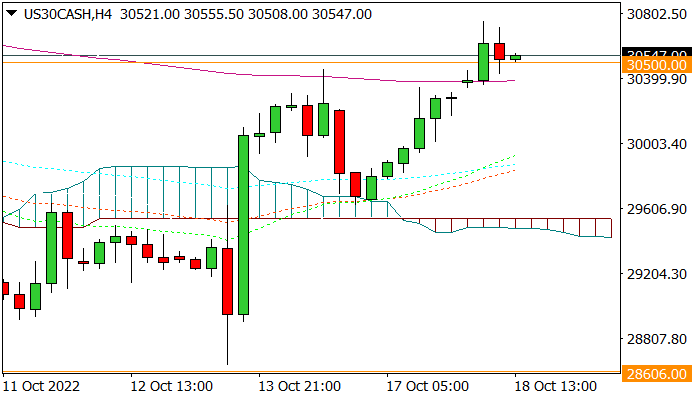

Technically, the Dow Jones index had been fluctuating in a rectangular pattern in the range of 28,600 to 30,500, which has now broken the upper level of the pattern. In the short term, the possibility of a bullish trend has increased. In addition, crossing the 34-day moving average and confirmation of the double bottom pattern has increased the potential of the Dow Jones index to rise in the short term.

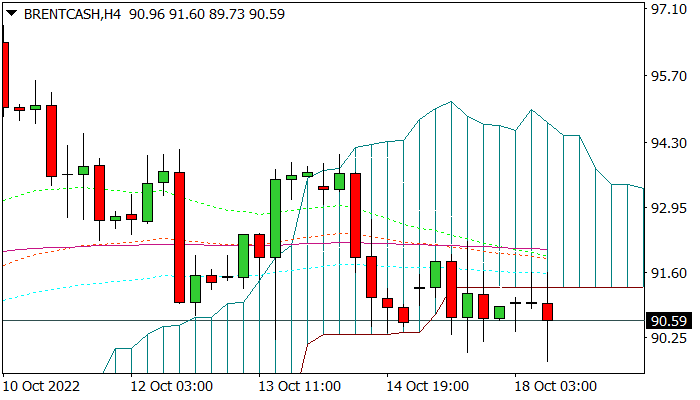

In the oil market and the Brent oil index, due to the forecast of a possible economic recession and a relative decrease in industrial demand, oil prices have fallen to $90 in correction conditions. Technically, the price is back down to below the 34-day moving average, and according to the 1-2-3 return pattern, there is a possibility of further correction and a decrease below the mentioned level.