Friday’s bearish engulfing weighs on near-term action

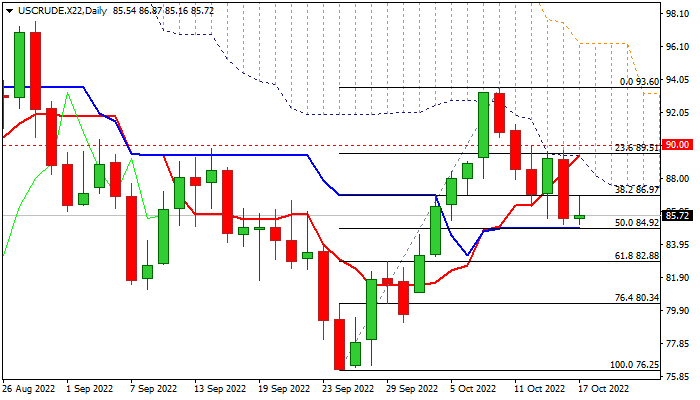

WTI oil remains under pressure at the beginning of the week, following Friday’s 4% drop (the biggest one-day loss since Sep 23) and continuing to pressure pivotal support at $84.92 (daily Kijun-sen / 50% retracement of $76.25/$93.60 rally).

The optimism on expectations for a stronger fuel demand from China, after the government announced a liquidity measures to boost the economy, had so far limited positive impact, though OPEC+ decision to cut production by 2 million bpd as from Nov1, would keep the price afloat.

Technical studies show fading bullish momentum on daily chart, mixed MA’s and oversold stochastic, lacking clear direction signal, though near-term action is weighed by Friday’s large bearish candle which also created a bearish engulfing pattern, as well as thick falling daily Ichimoku cloud, which capped the recent recovery and continues to track the downleg from $93.60 top.

Firm break of $84.92 pivot to signal bearish continuation and expose next pivot at $82.88 (Fibo 61.8%), loss of which would risk deeper fall.

Only bounce into daily cloud (base lays at $88.17) and regain of broken psychological $90 level would improve the structure and shift near-term focus to the upside.

Res: 86.97; 87.55; 88.17; 89.51

Sup: 84.92; 83.21; 82.88; 81.00