Near-term action looks for clearer direction signals

The Euro is standing at the front foot in early European trading on Monday, following a large swings on Thu/Fri.

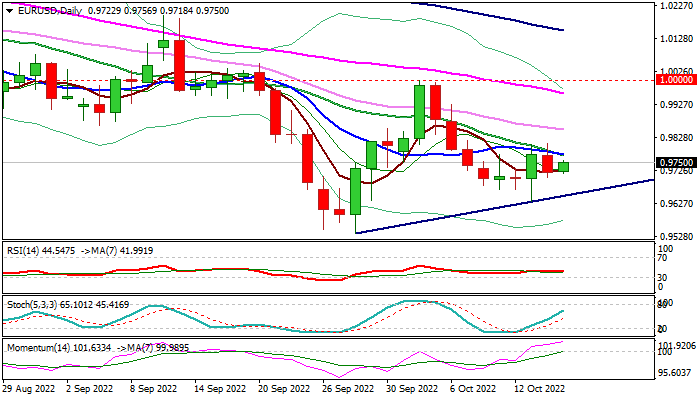

The action was repeatedly capped by falling 10DMA which reinforces a Fibo barrier at 0.9772 (38.2% of 0.9999/0.9631 bear-leg), with near-term bias expected to remain in neutral mode, while the latter caps.

Mixed daily studies (strong bullish momentum vs MA’s in bearish setup) contribute to directionless near-term mode.

Expect initial bullish signal on break and close above 0.9772 and Thu/Fri tops at 0.9808 that would open way for further recovery and expose pivotal barriers at 0.9859 (Fibo 61.8) and 0.9866 (daily Kijun-sen).

Conversely, dip and close below 0.9718/12 (broken Fibo 23.6% of 0.9999/0.9631 / Fibo 61.8% of 0.9535/0.9999)) would weaken near-term structure and make the downside more vulnerable.

Res: 0.9822; 0.9866; 0.9890; 0.9926

Sup: 0.9712; 0.9667; 0.9631; 0.9569