USDJPY at the back food ahead of Fed’s decision which will define near-term direction

The dollar remains at the back foot vs yen and ease further on Wednesday as traders await the verdict from FOMC.

Today’s bearish acceleration so far looks like positioning for fresh longs as larger picture remains bullish, however, dollar’s near-term direction will depend on signals from the US central bank.

Markets widely expect another 75 basis points hike today, but remain split in expectations what will be Fed’s next step, as recent speculations point to two scenarios – extended aggressive stance in policy tightening which will likely result in another 0.75% hike in December, or slowing the pace and opting for 0.5% increase next month.

The Fed is in difficult situation as it needs to fight red-hot inflation and this task so far had a priority, though such action would further slow economic growth and probably push the US economy behind the border line of recession.

Mid-term election in the US next week pose another problem for the central bank as they don’t want to upset more voters should the conditions worsen, which seems to be inevitable at the moment.

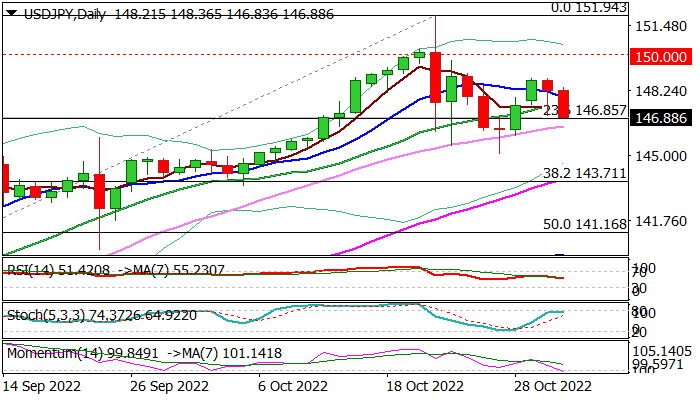

The dollar may fall through the first pivot at 145.10 (post -intervention pullback low) and threaten another key support at 143.71 (Fibo 38.2% of 130.39/151.94 / 55 DMA) if Fed softens its tone.

On the other side, fresh probe through psychological 150 barrier and possible attack at new 32-year peak (151.91) would be likely if the US central bank keeps its hawkish stance.

Res: 146.99; 148.84; 149.70; 150.00

Sup: 146.85; 146.45; 145.99; 145.10