USDJPY – bullish bias above 150, key US data eyed for fresh signals

USDJPY edged lower in late Asian / early European trading on Tuesday, following release of Tokyo CPI data which showed inflation jumping in February (2.5% from 1.8% previous month) and adding to expectations that the Bank of Japan may start to tighten its monetary policy soon.

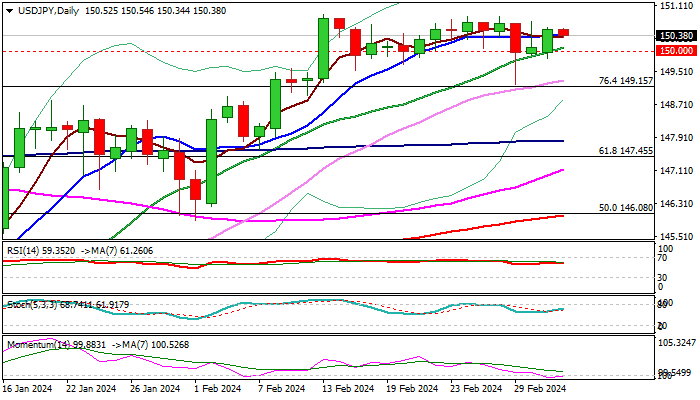

The pair steadies above broken psychological 150 barrier for the third consecutive week and also holds for the fourth week above broken Fibo barrier at 149.15 (76.4% of 151.90/140.25) bias with bulls.

Although near-term action is in a sideways mode, it keeps bullish bias while holding above 150 mark, for renewed attack at 2024 high (150.88, posted on Feb 13), violation of which to signal bullish continuation and expose key barriers at 151.94/90 (peaks of 2022/23.

Technical studies on daily chart remain bullishly aligned and support the action, but caution is required on existing risk of violating 150 pivot, which would weaken near-term structure and expose lower pivot at 149.15.

Key economic events this week (US non-manufacturing PMI / testimony of Fed Chair Powell / series of US labor data) will be closely watched for fresh signals.

Res: 150.72; 150.88; 151.43; 151.90

Sup: 150.00; 149.15; 148.57; 147.83