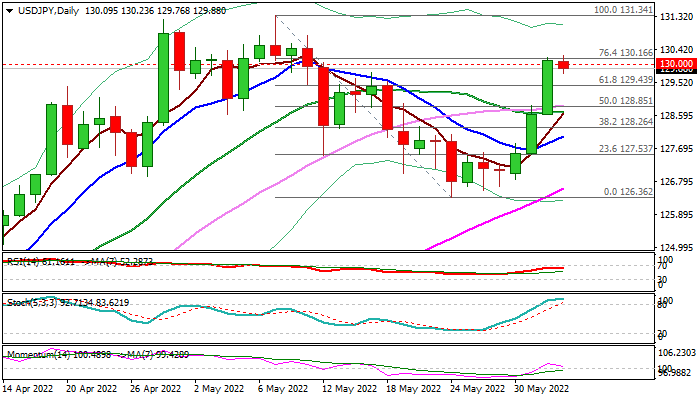

USDJPY – bulls pause at key 130 resistance zone ahead of US jobs data

The USDJPY is trading within a narrow range around 130 handle on Thursday, after recovery from 126.36 (May 24 low) accelerated on Wednesday (up 1.1% for the day) and cracked pivotal barriers at 130.00/16 (psychological / Fibo 76.4% of 131.34/126.36 pullback).

Close above these levels is needed to generate fresh bullish signal for recovery extension towards 130.80 (May 11 high) and key resistance at 131.34 (20-year high, posted on May 9).

Bulls remain firmly in play and underpinned by rising and thickening daily cloud, but overbought conditions on daily chart and fading bullish momentum suggest bulls may pause for consolidation ahead of key US jobs reports (ADP today and NFP on Friday which would provide more details about the situation in the US labor market and direction signals for the dollar.

Broken Fibo 61.8% barrier at 129.43 reverted to solid support which should keep the downside protected to maintain near-term bullish bias.

Caution on extension below 128.85 (daily Kijun-sen / broken Fibo 50%).

Res: 129.61; 130.00; 130.16; 130.80

Sup: 129.76; 129.43; 128.85; 128.26