Weak inflation increases bets for rate cut and keeps pound under pressure

Cable dipped after UK data showed inflation unexpectedly fell to three-year low in December (Dec y/y 1.3% vs 1.5% prev / f/c).

Weak inflation increases pressure on BoE to cut interest rates, which could occur as soon as the end of this month (BoE MPC policy meeting is scheduled on 30 Jan).

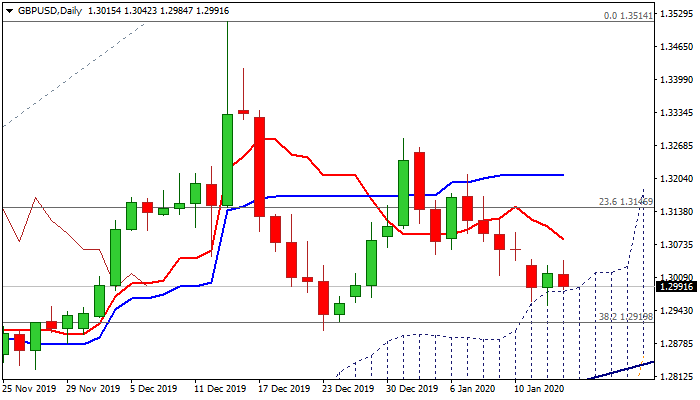

Fresh weakness cracked again psychological 1.30 support and top of rising daily cloud (1.2981) which contained attacks in past two days and signaled stabilization as thick rising daily cloud provides strong support.

The sentiment weakened after data, with daily MA’s (10/20/30) in bearish setup and momentum heading south, adding to negative near-term outlook.

Bears need penetration and close within cloud to generate negative signal for extension towards next key supports at 1.2919/04 (Fibo 38.2% of 1.1958/1.3514 ascend / 23 Dec trough).

On the other side, repeated close above cloud top would generate initial signal that bears might be running out of steam and continue to move within extended narrow consolidation.

Daily Tenkan-sen heads south and offers solid resistance at 1.3083, which is expected to cap upticks and keep negative bias.

Res: 1.3042; 1.3083; 1.3098; 1.3209

Sup: 1.2981; 1.2954; 1.2919; 1.2904